Analyzing Crowdfunding Total Funding Volume

Crowdfunding has become a popular alternative method for fundraising that has allowed an individual or company to bring an idea to life without going through the traditional fundraising channels such as stock sales, venture capital investment, and more.

Instead of the myriad regulatory hurdles that can accompany registering with the Securities & Exchange Commission (SEC), crowdfunding allows the creator to go straight to the consumer with their proposed idea. The fundraiser goes to the “crowd” or the general public with their product or idea, and if enough people also buy in, then the creator will use investors’ money in an effort to bring the project to life and to completion.

Crowdfunding Becomes Popular Investment Platform

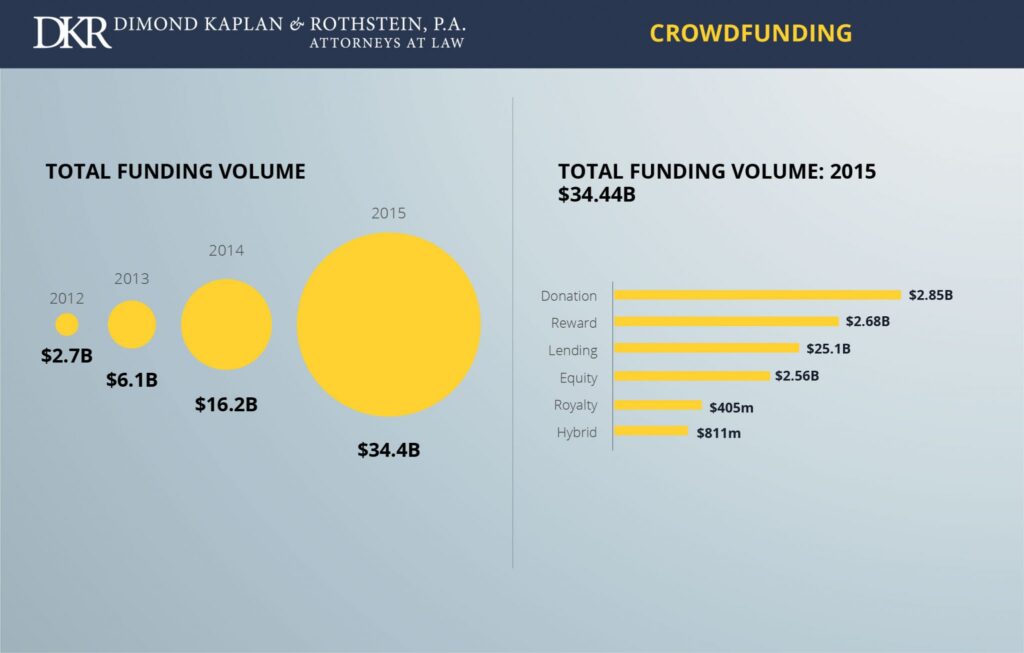

The above chart demonstrates how popular crowdfunding has become by showcasing the crowdfunding total funding volume. Between 2012 and 2015, the amount of money invested in various crowdfunding platforms jumped from $2.7 billion to more than $34 billion, a more than twelve-fold increase in just three years’ time.

Of course, financial regulators understood the potential for abuse from unscrupulous fundraisers, especially with such a rapidly growing and popular investment vehicle, so the industry has become increasingly regulated.

Crowdfunding Concerns

Although there are many crowdfunding platforms, you should make sure that the one you are investing through has a stellar history and is compliant, and that the company or individual doing the fundraising is also reputable.

Just like with any other investment, if you have any questions about how crowdfunding works, or if you have been the victim of someone’s crowdfunding scam, you should contact an experienced securities attorney to discuss your legal rights.

DKR Securities Fraud Attorneys Can Help

With offices in Los Angeles, New York, Miami and West Palm Beach, our securities lawyers have helped investment fraud victims throughout the U.S. recover more than $100 million from banks and brokerages firms for their wrongful actions.

Call a Securities Fraud Attorney Today

Contact a securities fraud attorney at Dimond Kaplan & Rothstein, P.A. today to schedule an appointment or consultation to review your rights and options.